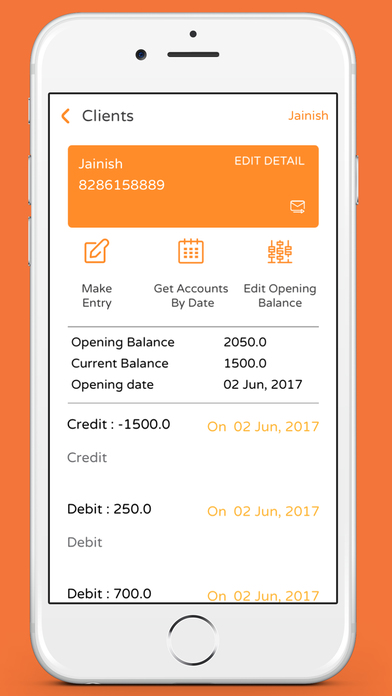

On Mobile Banking, ‘My Spending’ is available for each individual account. De-select your accounts to change the view to specific accounts. Yes, on Internet and Tablet Banking My Money Manager defaults to the ‘My Spending’ page and has selected all of your accounts. This will permanently remove the sub-category from the list and any transaction which had been re-assigned to it by you will revert to the original child category defined.Ĭan I see My Spending for each of my accounts? This can be done tapping on the edit icon and then choosing the 'Delete a custom subcategory' option for the sub-category. The existing primary and sub-categories cannot be deleted but it is possible to delete a sub-category that you have created. Yes, if you create a new category on either your Internet or Tablet banking, it will show across all of your online banking options. If I create a new category, will it automatically show on my Internet, Tablet and Mobile Banking? You can create new categories on Internet or Tablet banking, however it is not possible to create new categories on the Mobile Banking App. A blank text box will be displayed and you can enter the new sub-category name to associate with the transaction(s). You can tap on the edit icon beside transaction details where you will see the option 'Add a custom category'. The primary categories cannot be changed but you can create up to 10 new sub-categories. Recategorisation can be completed as a once off by choosing 'Apply Once' or for all historic and future transactions by choosing 'Apply Always'. Once tapped this will open the list of available categories to which you can reassign a transaction to. This can be done within either My Spending by tapping anywhere you see the edit icon along the transaction details line beside a category.

If a transaction is not in the category that you would prefer to see it you can re-categorise it and assign it to another more suitable category for you. What if I want to change the category of a transaction? See table below for the complete list of categories.

In My Money Manager there are currently 16 main categories, which each can be broken down to further sub-categories. What accounts will I be able to view on My Money Manager?Ĭategorisation is putting your transactions in to groups such as Shopping, Leisure and Entertainment etc. On AIB Mobile Banking, the My Spending category is available and has been customised to display the information clearly on your phone.

#MYMONEY ONE ACCOUNT FULL#

My Categories Manager: you can search for specific transactions and create rules to recategorise transaction information within My Money ManagerĪIB Internet Banking and AIB Tablet Banking provide the full functionality of My Money Manager.My Savings Goals: you can set up financial goals associated with saving accounts.My Budgets: you can create budgets for spending categories.My Spending: provides you with dynamic charting to analyse spending and income across different categories.My Money Manager will also allow you to view and analyse your key financial information via the following tools: You will have access to 13 calendar months of transactions. holiday, car, house or to set monthly spending budgets.

#MYMONEY ONE ACCOUNT HOW TO#

My Money Manager allows you to see how you are spending your money in a user friendly format, which can help you inform decisions on how to save money for a future goal e.g. My Money Manager is a tool to help you track your income and expenditure on your Current, Deposit and Credit Card Accounts and to create budgets and savings goals.

0 kommentar(er)

0 kommentar(er)